https://drive.google.com/file/d/1yPkJHUe1RUzIBdrHkONERE9QeYbnUJCZ/view?usp=sharing

This project aims to develop and deploy a decentralized futures trading platform on the Aptos blockchain. This platform focuses on offering seamless trading of short-term futures contracts expiring within 24 hours, with the potential to include longer-dated contracts in the future.

First clone the repo to your local machine

git clone 'repos url'

Go to the project directory

cd futurefrontendInstall dependencies

npm iStart the server

npm run startThe frontend will be hosted locally at https://localhost:3000/ by default.

enter your private key here module name

APTOS_NODE_URL="https://fullnode.devnet.aptoslabs.com/v1"

ACC_PRIV_KEY="0xf603ba08e7ca86fcf30297bb4c4fbc2fc2599f890052f73b16dfbe7e"

MOD_NAME="Coin1"

EXP_ORD_FUNC="expiryOrderBookNotMatch"

MARKET_PRICE_FUNC="MarketPriceList"

PLACE_ORDER_FUNC="place_Order"Create .env file like above and then run the below code to start server.

pip3 install -r requirement.txt

python3 main.pyYour server will start on localhost:8000 by default.

Setup Aptos CLI Prerequisites First, ensure you have Python 3.6+ installed:

$ python3 --version

Python 3.9.13

using wget

wget -qO- "https://aptos.dev/scripts/install_cli.py" | python3

using curl

curl -fsSL "https://aptos.dev/scripts/install_cli.py" | python3

iwr "https://aptos.dev/scripts/install_cli.py" -useb | Select-Object -ExpandProperty Content | python3

Setup your enviroment following the steps https://aptos.dev/tutorials/build-e2e-dapp/create-a-smart-contract

Compile the code

aptos move compile

Run test cases

aptos move test

Publish the contract

aptos move publish

The contract is deployed on Aptos Explorer's DEVNET, hence one need Petra Wallet,

Aptos's wallet connected to DEVNET and having some APT (extracted from faucet) for proceeding with transactions.

Address where required modules are published :

Installation Guide - https://petra.app/

This proposal endeavors to pioneer the development of a cutting-edge decentralized futures trading platform, seeking to rectify the inherent shortcomings of prevailing Web2 paradigms. Web2 platforms are notorious for their susceptibility to security breaches and the centralized authority they vest with single points of control, enabling potential market manipulations.

The envisioned platform, rooted in Web3 principles, aspires to surmount these challenges. Tailored to prioritize short-term futures contracts with a 24-hour expiration window, the platform holds the potential to integrate more extended contract durations in subsequent phases.

Diverging from the conventional monthly cycles, this innovative platform introduces zero-day futures, characterized by their rapid expiration. Notably, users retain the autonomy to extend the expiration period, augmenting the adaptability and sophistication of their trading strategies. This paradigm shift not only bolsters security measures but also champions a democratized approach to futures trading, liberating users from the constraints of centralized control and fostering a more equitable and transparent financial ecosystem.

We present to you our future finance app that solves all the issues of Web2 and utilizes Aptos abilities to its maximum. Future wallet offers zero day futures for various tokens. Our solution uses Aptos quick transactions and computation power of move language. Without the need of a backend acting as a storage unit our solution eliminates the need for the main server. The computation and storage is carries out the contract itself, thus removes problems such as server downtime .

The user first needs to connect his wallet making sure he is connected to the DEVNET and has some APT from the faucet.

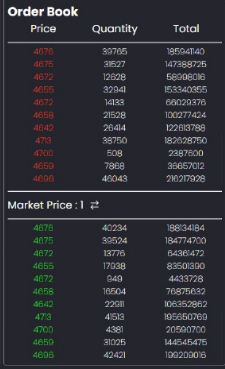

- The order book of a specific token displays the Order placed throughout the platform, it displays both buy and sell orders. It updates at an interval of 3 sec, It involves no third party and directly interacts with the contract.

- Rather than conventional ways of using loops and iterating through the entire orderbook, we have implemented heaps that efficiently match prices in

log(n)T.C. - Market orders are instantaneously matched while limit orders wait for their price to be matched.

- This allows the conventional web2 users & analysts to analyze and study the market depth.

- The order book clears at

EODaccording toISTand the non matched orders are returned to the users.

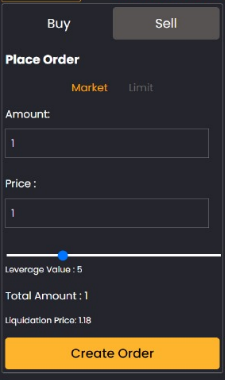

A user can place 2 kinds of buy and sell orders namely Limit and Market Orders. It works exactly as a conventional future platform. Orders are directly added to the blockchain, thus having secure transactions.

The user has to select the token in which they want to trade. Currently, we offer 5 different tokens currently with the ability to add more before final deploying. The tokens are independent of each other and run parallely in different contracts, making them

The user selects their type of order whether buy or sell.

-

- Unlike traditional sites that offer in lot sizes the user can specify any quantity and there is no minimum for it.

- Predicting market trends the user selects the price for their limit order.

- With the help of a slider the user selects the

Leveragewhich is offered in a multiple of 5. - It also displays the

liquidation pricewhich is capped at90%and prevents defaults, the orders liquidate which fail to meet this criteria.

-

- Again the user specifies the amount which they want to buy/sell

- The price is set to the market price of the orders, that is for buyers the lowest of sellers and for sellers the highest of buyers.

- These orders are instantaneously matched, If the quantity at highest price finishes the price moves on to the next orders till the quantity is not satisfied.

After clicking confirm the Petra wallet prompts to pay the amount and gas fees.

Transactions can be placed using three ways -

- From

Frontend(for normal users) - From

Aptos Explorerfor testing purpose, one can navigate to the module address and see the core functioning. - From

Python SDKfor market simulation and stress testing. We have also provided a script for tests.

Our matching algorithm utilizes FIFO (First In First Out) algorithm for order matching, if the prices match the orders are matched according to their timestamps.

The orders which are matched are automatically removed from the order book and pushed to the success book.

The orders of the user themselves are displayed in the successful transaction section. One can view their order details and also see real time profit or loss according to current market price on their order book.

At the end of the day the profit and loss is transferred to the user from the Resource Account, there is no generation of money in the market, ones profit is the loss of another.

The orders who suffer loss more than the income are automatically liquidated at any point of the day.The liquidation is set to 90% and prevent the risk of defaults.

One of the key features that differentiates Zero day orders from rest of the futures platforms is it ability to extend its day of expiry, one can edit the

After the orders are matched the user can opt to edit the expiry of contract, at the end of each day the orders price would be calculated using the profit and loss of the user at EOD and again placed with same quantity , this process is repeated till the time the contract does not expire while also checking for liquidation throughout the day.

The platform provides the facility to view the current market price going on in the market and see a detailed candlestick chart of it.

The market price of the buy and sell orders going on for each individual token and providing a live graph of it.

All the data of the graph is sourced from fastAPI calls that provide the required data, as the data is sourced directly from the blockchain this is guaranteed to be free of manipulation. To prevent overloading of requests of data from contract the data is fetched using API calls that are evenly spaced. The data is stored locally on the browser cache.

The candlestick chart pattern provides the accurate real time current time market price to determine possible price movement based on past patterns. Candlesticks are useful when trading as they show four price points (open, close, high, and low) throughout the period the trader specifies. These can be used to develop strategies for algo trading.

The Market price of each of the token is displayed depending to the token selected and a line chart for it displayed. It lets the buyers and seller on the platform be more aware of prices and form stratergies accordingly.

The platform utilizes the feature of resource account to store and trafer APT, since storing in account of the deployer would raise security concerns a non mutable contract hosted on the resource account allows seamlesss transactions and makes sure that their is no need to approve the transactions by the deployer.

At the expiry, the profit and loss is transfered to the users, this call happens from the backend, to prevent overcalls of contract at EOD we have set a time window from 23:55 to 00:00 during this time a call can be made, once a user makes a call ( automatically happens when a order is placed during this time span) another call does not take place until the next EOD, for futher details checkout changeJ fucntion in the contract.

Requirements

fastapi

aptos-sdk

"uvicorn[standard]"

apscheduler

numpy

python-dotenv

Our model uses the Time Series Analyses and implements a Exponential 3 degree model : Holts Winter to forecast the upcoming trends. We provide the model current market prices, the model checks for three patterns mainly

- Seasonal

- Periodic

- Trend After analyzing the data it provide one of the four outcomes

"volatile but bullish"

"volatile but bearish"

"safe and bearish"

"safe and bullish"

We display these results on the frontend to help users to study the current position of the market. This is result is refreshed at an interval of every 3 sec.

The contract is published on address of contract , it can be view on the aptos explorer.

to run the file locally setup the aptos CLI as stated above.

The contract imports the standard libraries, we have provided some error prompts to improve testiabality of the code.

- Order : Explains the structure of orders.

- BuyOrder and SellOrder : Contains a Vector of Orders placed by users on that particular day.

- TotalSuccessOrder : Contains a Vector of the Matched Orders.

- BuyMap and SellMap : Stores all the Buy and Sell Prices.

- BuyHeap : Maintains a sorted list of buy prices, with the highest price at the top.

- SellHeap : Maintains a sorted list of sell prices, with the lowest price at the top.

- MarketPriceList : Maintains a record of current market prices .

- ModuleData : Stores the sign of the resource Account.

- getBuyList : Returns the list of

BuyOrderson that particular day and n-day orders which haven't yet expired - getSellList : Returns the list of

SellOrderson that particular day and n-day orders which haven't yet expired - getTotalSuccessList: Returns the list of orders successfully placed on a particular day

- getCurrentMarketPrice: Returns the current Market Price

- place_Order : Used to place order, arguments given to it are quantity, price, side (either buy or sell), leverage (can be upto 25x)

- market_place_Order : Used to place order on the market price

- editSuccessOrders : Used to roll over expiry of a successful contract to n-days

- matchOrder : Used for matching algorithm using FIFO algorithm, heap data structure is used for keeping list of buyOrders and sellOrders

- expiryOrderBookNotMatched : Called after every placeOrder to check whether the contract has expired to ensure 24-hour expiry

- liquidationLoop : Checks whether prices exceeds its liquidation price i.e. it incurs loss more than its initial investment. We have capped it at 90% to reduce defaults

We have added functionality of zero days as well as K days of expiry, morever within this expiry user can extend/rollover to N days.

A fastAPI backend is used for implement the market and transaction APIs. The APIs are based on PythonSDK provided by Aptos.

To store historical market data, we can emit events whenever an order is placed. We can track all the events emitted using Aptos Lab hosted Indexer GraphQL API and store the data on a PostgreSQL server. This time series data can be used to make better predictions and can be exposed to people interested in algorithmic trading.